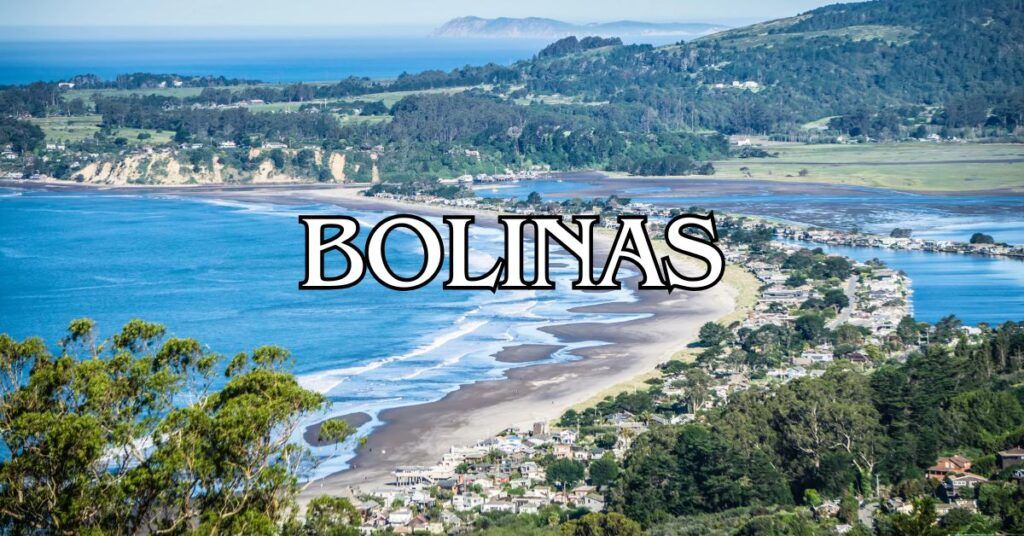

Tucked away on the California coast, Bolinas is one of Northern California’s best-kept secrets. This small town in Marin County blends natural beauty with a quirky, artistic spirit. Many visitors drive right past it—locals have a habit of removing road signs that point to their little paradise.

Bolinas gives you a rare glimpse of coastal California untouched by mainstream tourism, with stunning beaches, world-class surfing spots like “The Patch,” and the West Coast’s oldest saloon. The town’s fiercely independent character is impossible to miss. Artists, surfers, and nature lovers have all helped preserve its authentic charm.

Discover hand-picked hotels and vacation homes tailored for every traveler. Skip booking fees and secure your dream stay today with real-time availability!

Browse Accommodations Now

Just two hours north of San Francisco, this secluded hamlet rewards anyone who manages to find it. You’ll stumble onto miles of rugged coastline, unpretentious but tasty food, and a lively arts scene. If you’re looking for a weekend escape where California’s counter-culture is still alive, Bolinas is it.

Getting to Bolinas

Bolinas is about 30 miles north of San Francisco, tucked along the coast with barely any signage. You’ll need to do a little planning, but the drive is worth it for the coastal views alone.

Driving Directions

From San Francisco, head north on Highway 101 and cross the Golden Gate Bridge. Take the Highway 1/Stinson Beach exit and follow the winding road. After Stinson Beach, continue for about 5 miles. Keep your eyes peeled for the unmarked turnoff to Bolinas-Fairfax Road on the left.

Locals often remove road signs to keep tourists at bay, so don’t rely solely on GPS—it can be spotty here. The drive usually takes about an hour if you dodge the worst of the traffic.

From Mill Valley, take Panoramic Highway west (it becomes Highway 1), then follow the same route after Stinson Beach.

Public Transportation Options

Getting to Bolinas by public transit isn’t easy, but it’s doable. Hop on Golden Gate Transit to the Manzanita Park & Ride near Mill Valley. From there, Marin Transit bus #61 heads to Bolinas. The bus doesn’t run often, so double-check the schedule before setting out.

The West Marin Stagecoach also serves the area, but not very frequently—especially on weekends.

Bring exact change for the bus. The whole trip from San Francisco can take 2-3 hours, depending on your luck with connections.

Nearby Airports

The nearest major airport is San Francisco International (SFO), about 42 km away. From SFO, you’ll need to rent a car or brave the patchwork of public transportation.

Oakland International (OAK) is a bit farther but sometimes has better deals or fewer delays.

Both airports have rental cars. If you’re using public transit, you’ll have to make several transfers—first to San Francisco or Marin, then follow the bus directions above.

No direct shuttles go from the airports to Bolinas, unlike some other Bay Area spots.

Where to Stay in Bolinas

Bolinas has a handful of places to stay, ranging from historic hotels to vacation rentals with ocean views. The limited options help keep the town’s laid-back vibe and prevent it from getting overrun.

Hotels and Inns

Smiley’s Schooner Saloon & Hotel is probably the most iconic place to stay here. It’s been around since 1851 and has simple rooms above the saloon. Prices are reasonable, and you’ll get a real taste of local flavor.

The Grand Hotel is a bit more upscale, with well-furnished rooms. It’s small but comfortable and right in the middle of town.

Sandpiper Lodging at the Beach is a no-frills spot just steps from the ocean—perfect if you want to maximize your beach time.

The Garden Room is the only bed-and-breakfast in Bolinas. It’s up on the mesa, with a single cozy room, breakfast, and peaceful garden views.

Vacation Rentals

For longer stays, vacation homes are your best bet. Plenty of coastal cottages and houses offer ocean views, full kitchens, and private yards.

You’ll find everything from rustic cabins to sleek beach houses. Most require a 2-night minimum, and prices jump during summer or if you’re close to the water.

If you want the best places, try to book 3-6 months ahead—especially for summer weekends. Most rentals are listed on the big platforms, but some locals still use community boards.

If Bolinas is booked up, check Stinson Beach nearby for more options.

Camping Near Bolinas

There aren’t any official campgrounds in Bolinas, but you’ll find great spots close by. Point Reyes National Seashore, just north, has four hike-in campgrounds with basic amenities and incredible coastal views.

Olema Campground near Point Reyes Station has tent and RV sites with hookups, hot showers, and laundry. It’s convenient for exploring both Bolinas and Tomales Bay.

Samuel P. Taylor State Park, about 20 minutes inland, offers redwood forest camping with developed sites and cabins. It’s a totally different vibe from the coast.

If you want to camp right on the beach, Steep Ravine Environmental Campground south of Stinson Beach has rustic cabins and tent sites with wild ocean views. These book up fast, sometimes months ahead.

Best Things to Do in Bolinas

Bolinas is all about natural beauty and small-town charm. You’ll find plenty of outdoor adventures and local culture that really capture the spirit of this offbeat spot.

Outdoor Activities

Surfing is huge in Bolinas. “The Patch” is famous for its waves—beginners and seasoned surfers both love it. Bolinas Beach has gentle breaks, so if you’ve never surfed, this is a good place to try.

Agate Beach County Park is great for tide pooling. You’ll spot starfish, anemones, and all kinds of marine critters. Both Agate and Bolinas Beach welcome dogs, so bring your pup.

Hiking? There’s a lot. Point Reyes National Seashore is just a short drive away, with epic views and wildlife. The Palomarin Trail is a local favorite, winding out to Bass Lake and Alamere Falls.

Find the perfect hotel or vacation rental. Instant booking, no fees!

View Top Stays

Kayak the Bolinas Lagoon for a peaceful paddle and a chance to see birds and harbor seals up close.

Cultural Experiences

The Bolinas Museum packs a lot into a small space, showcasing the town’s history and artistic roots. Exhibits cover everything from schooner-building to environmental activism. The art gallery rotates local artists’ work.

Smiley’s Schooner Saloon—open since 1851—claims to be California’s oldest saloon. It hosts live music on weekends and is the heart of the community.

Downtown, you’ll find art galleries and little shops selling handmade goods. Chat with the shopkeepers—they often have great stories about Bolinas.

Gospel Flat Farm Stand runs on the honor system and sells fresh produce. It’s a little window into Bolinas’ commitment to community and sustainability.

Bolinas Beaches and Coastal Attractions

Bolinas has some of the most untouched coastal areas in Northern California. The beaches and lagoon attract surfers, nature lovers, and beachcombers all year.

Bolinas Beach

Bolinas Beach runs along the town’s west edge—a perfect spot for relaxing or catching waves. Surfers flock to “The Patch” for some of the best breaks around.

Unlike Stinson Beach, Bolinas Beach usually feels empty, even in summer. Beginners will find gentle waves here, and the views of the Point Reyes Peninsula are hard to beat.

Parking is tight on summer weekends. If you want a quieter experience, try visiting on a weekday or early morning. There’s no fee for beach access, but some spots might be closed during wildlife nesting season.

Exploring the Lagoon

Bolinas Lagoon sits right next to town—a 1,100-acre tidal estuary full of wildlife. It’s a haven for birdwatchers and anyone who likes spotting harbor seals.

Rent a kayak or paddleboard in town (usually $25-35/hour) and cruise the calm water. You’ll see egrets, herons, and sometimes even otters.

Trails connect the lagoon to the greater Point Reyes area. The Bolinas Lagoon Loop is an easy 1.8-mile walk, great for birding.

Low tide reveals mudflats where shorebirds feed. Mornings tend to be calmest and best for wildlife spotting.

Dining and Local Cuisine

There aren’t a ton of restaurants in Bolinas, but the ones here focus on fresh seafood, local produce, and that easygoing coastal vibe.

Notable Restaurants

Smiley’s Schooner Saloon is the town’s historic anchor—a bar, restaurant, and social hub all rolled into one. The menu leans comfort food with a coastal twist, and the atmosphere is pure Bolinas.

Coast Cafe is a local go-to for seafood and California-style dishes in a laid-back setting. People rave about the fish tacos and clam chowder.

BoVida gives Bolinas a modern touch, serving seasonal, creative dishes. The menu changes often to highlight what’s fresh.

Eleven is more upscale, with a small, carefully chosen menu that spotlights local ingredients.

Cafés and Bakeries

Bolinas has a couple of cozy cafés—perfect for a morning coffee or a lazy afternoon treat.

The Garden Room is known for its house-made pastries and organic coffee. The outdoor seating is peaceful, a nice spot for breakfast or a light lunch.

You’ll also spot small coffee stands that pop up seasonally, serving local beans and simple baked goods. These little outfits really show Bolinas’ DIY spirit.

If you’re craving more bakery options, Stinson Beach is just a short drive and has plenty of choices for bread and sweets.

Farm-to-Table Experiences

Gospel Flat Farm Stand is a favorite for local produce, flowers, and eggs—all on the honor system. It’s as fresh as it gets.

If you’re staying in a rental with a kitchen, grab ingredients here or from other local producers and make your own farm-to-table meal.

In summer, look for community farm dinners around town. Local chefs serve multi-course meals using ingredients grown right nearby.

The Bolinas Community Farmers Market pops up seasonally, bringing together growers, food makers, and craftspeople to celebrate the area’s bounty.

Arts, Heritage, and Local Culture

Bolinas has a creative streak a mile wide. Artists and free spirits have shaped the town’s identity for decades, and you can feel that energy in its galleries, events, and old-school hangouts.

Art Galleries

The Bolinas Museum anchors the art scene. It’s small but always interesting, with works by local artists and exhibits about the area’s history and natural world. Rotating shows keep things fresh.

Independent galleries dot the downtown, featuring everything from paintings and sculpture to photos of the dramatic coastline. Many artists open their studios by appointment—if you’re curious, just ask around.

Art walks during certain seasons bring the whole scene to life. Galleries stay open late, artists mingle, and the whole town feels like one big creative gathering.

Music and Performance Venues

Smiley’s Schooner Saloon, the West Coast’s oldest continuously operating saloon, has been Bolinas’ main music spot since 1851. Local bands and the occasional touring act squeeze onto its small stage, and the old wooden floors seem to hum with the energy of all those past shows. The vibe? Genuinely authentic—maybe even a little rough around the edges, in the best way.

Luxury stays to cozy cottages await, all with instant booking. Find the best deals!

Browse Marin Stays

The Bolinas Community Center pulls together a mix of live music, folk shows, and small theater productions by local troupes. It’s the kind of place where you might stumble into a poetry reading or a community concert, and everyone’s probably related somehow. If you want to get a feel for the town’s creative pulse, this is where you’ll find it. Gathering place is an understatement.

And if you’re around during summer, don’t be surprised if you catch a group of musicians jamming at the beach as the sun dips down. These informal sunset sessions are pure Bolinas—unplanned, a little wild, and totally free-spirited.

Hiking and Outdoor Adventures Near Bolinas

Bolinas sits right at the edge of some of Northern California’s best outdoor adventures. Whether you’re a hardcore hiker or just want a mellow nature walk, you’ll find a trail that fits.

Popular Hiking Trails

Alamere Falls is a classic. This 8.4-mile round-trip hike through Point Reyes National Seashore ends at a waterfall that drops straight onto the beach—a rare sight on the West Coast. The trail itself isn’t easy, but the mix of coastal views and changing landscapes makes every step worth it.

If you’re after something gentler, the Bolinas Lagoon Preserve has easy trails and stellar birdwatching. You can stroll along, spot herons and egrets, and take in the view of Mount Tamalpais.

For more of a workout, hit Cataract Falls near Mount Tamalpais State Park. The hike winds through lush forest and passes a string of waterfalls, especially impressive after spring rains.

Palomarin to Bass Lake is another favorite. The trail leads you through coastal scrub to a lake perfect for swimming if you’re feeling brave. The trailhead sits just north of town.

Scenic Drives

Highway 1 delivers jaw-dropping views of Bolinas Lagoon and the Pacific. There are a few pullouts—don’t skip them if you want a shot at spotting seals or even whales.

Olema Bolinas Road winds through hills and farmland, connecting Highway 1 to downtown Bolinas. It’s quieter than the main highway but just as pretty.

If you’re up for a longer drive, take the Panoramic Highway from Bolinas to Mill Valley. You’ll snake through redwoods and catch glimpses of San Francisco Bay that’ll have you pulling over for photos.

And then there’s Ridgecrest Boulevard, which runs along the spine of Mount Tamalpais. On a clear day, you can see all the way to the Farallon Islands. It’s dramatic—almost ridiculously so.

Day Trips and Nearby Destinations

Bolinas makes a great jumping-off point if you want to explore Marin County’s other gems. Each nearby town has its own quirks and character, so don’t just stick to one place.

Stinson Beach

Only about 15 minutes south, Stinson Beach feels totally different from Bolinas. The three-mile stretch of sand is ideal for swimming if the surf’s mellow, and lifeguards are on duty in summer.

The village has a handful of solid food spots—Parkside Café is a breakfast favorite, and Siren Canteen does casual eats right on the beach. Both fill up fast on weekends, so getting there early is smart.

Unlike Bolinas, Stinson Beach actually has road signs and seems to welcome outsiders. The parking lot, though, is a battle on sunny days. If you want a spot, aim for before 10am.

If the fog rolls in, browse the shops along Highway 1 or hop on the Dipsea Trail for a hike toward Mount Tamalpais.

Exploring Point Reyes Station

About 15 minutes northeast, Point Reyes Station is the commercial heart of West Marin. It used to be a railroad town, but now it’s more of a gateway to Point Reyes National Seashore.

Don’t miss:

- Cowgirl Creamery—grab a cheese sample or two

- Toby’s Feed Barn—part market, part local crafts fair, part community hangout

- Bovine Bakery—lines out the door for a reason

- Bookstore Point Reyes—quirky, well-curated, and full of local history

Saturdays from April to November, the farmers’ market takes over, with local produce and handmade treats. The old buildings give the town a kind of faded, lived-in charm.

Visiting Tomales

Drive about half an hour north and you’ll hit Tomales, a tiny town that feels almost untouched since the 1850s. The William Tell House claims to be Marin’s oldest saloon—stop in for oysters and a cold beer if you’re into that sort of thing. Tomales Bakery is worth the detour for fresh bread and pastries alone.

Rolling hills and dairy farms surround the area, and Tomales Bay is just a short hop away—famous for kayaking and oysters pulled straight from the water.

Weekdays are best if you want that slow, quiet, rural vibe.

Olema and Point Reyes National Seashore

Olema sits at the southern entrance to Point Reyes National Seashore, about 20 minutes from Bolinas. The town itself is tiny, but it’s a solid base camp for exploring the park.

Point Reyes National Seashore sprawls over 71,000 acres of protected coastline and forest. The Bear Valley Visitor Center in Olema has maps, exhibits, and helpful rangers.

A few highlights:

- Hike to Alamere Falls (yes, it’s that good)

- Climb up to the Point Reyes Lighthouse—views are wild

- Spot tule elk, elephant seals, and, if you’re lucky, some of the 490+ bird species

- Walk the Earthquake Trail and stand right on the San Andreas Fault

The Five Brooks trailhead nearby offers quieter hikes through old-growth forest. Give yourself at least half a day, and bring layers—the weather can flip fast.

Travel Tips and Visitor Information

Visiting Bolinas takes a little planning and a bit of local know-how. The town has its quirks, and honestly, that’s part of the charm.

Best Times to Visit

Bolinas stays mild all year, but May through October is usually the sweet spot. Days run 60-75°F, and there’s less fog than you’d expect for the coast.

September and October are often the warmest and clearest—prime time for beach days and hiking. Weekdays are way less crowded. Summer weekends can get a little hectic.

Winter (November-March) brings more rain and cooler temps, but it’s still pretty moderate. Not great for swimming, but if you like storm watching or empty trails, it’s actually kind of magical.

Spring (April-May) is when the wildflowers come out, and the crowds haven’t really arrived yet.

Local Etiquette

People in Bolinas really care about their privacy and the small-town feel. The town keeps a low profile—locals sometimes take down road signs pointing the way, and honestly, who can blame them?

If you visit, keep noise down, especially in neighborhoods. Only park where you’re supposed to—parking’s tight and they do enforce it.

Support local shops instead of bringing everything with you. The Bolinas General Store and People’s Store usually have what you need.

Taking photos is fine in public, but if you want to snap a shot of someone’s house or a resident, just ask first.

And, of course, pack out your trash. Stick to Leave No Trace on trails and beaches. It’s just good manners.

Safety Considerations

Bolinas Beach has strong currents, and there aren’t any lifeguards on duty. Before heading out for a walk, check the tide schedule—rising water can sneak up on you and leave you pressed against the cliffs.

Cell service? Pretty unreliable in most parts of town. It’s smart to download maps ahead of time, and if you’re hiking somewhere off the beaten path, let someone know your plans.

If you need a hospital, you’ll have to drive about 20 minutes to Point Reyes Station. Don’t forget any medications you might need.

Poison oak pops up all over the local trails. If you don’t know what it looks like, remember the old saying: leaves of three, let it be. Stick to the marked paths and you’ll probably be fine.

Parking is a headache—there’s just not much of it. Carpool if you can, or aim to get there early, especially on busy weekends and holidays.

Find available hotels and vacation homes instantly. No fees, best rates guaranteed!

Check Availability Now